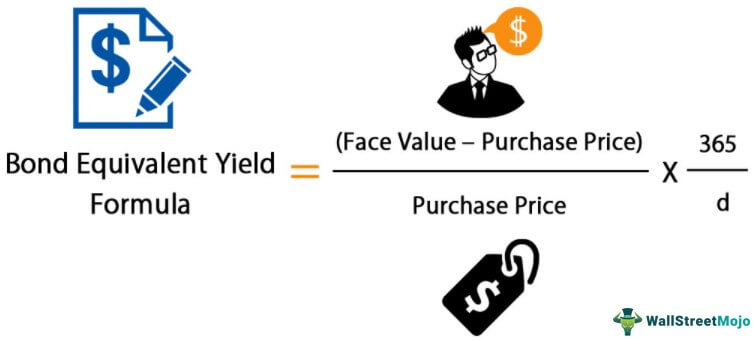

Bond equivalent yield formula

Mathematically the formula for coupon bond is represented as. Another aspect of analyzing bonds equals the yield to maturity which we quote as the bond equivalent yield.

Chapter 11 Bond Yields And Prices Ppt Video Online Download

The payout at maturity when the bond matures or the par or face value.

. Dividend 2000 Therefore the company paid out total dividends of 2000 to the current shareholders. The formula for calculating YTM is shown below. This shows how for the same 1 increase in yield the predicted price decrease changes if the only duration is used as against when the convexity of the price yield curve is also adjusted.

You can learn more about financial analysis from the following articles. The face value of a bond or any fixed-income instrumentPar value is also known as Face Value or Nominal Value. Dividend Formula Example 2.

A bonds yield refers to the expected earnings generated and realized on a fixed-income investment over a particular period of time expressed as a percentage or interest rate. Because of the tax-exempt nature of municipal bonds. Where Number of preferred stocks.

Here we discuss how to calculate bond yield along with practical examples and a downloadable excel template. Current trading price Δyield. The bond yield curve plots the YTM against time.

If a bond is trading in excess of its face value the current yield is lower than the coupon rate. 1 072 2 1 7123. At par the current yield is equivalent to the coupon rate.

The term bond formula refers to the bond price determination technique that involves computation of present value PV of all probable future cash flows such as coupon payments and par or face value at maturity. After 5 years the bond could then be redeemed for the 100 face value. Bond price when yield increases by 1 Price-1.

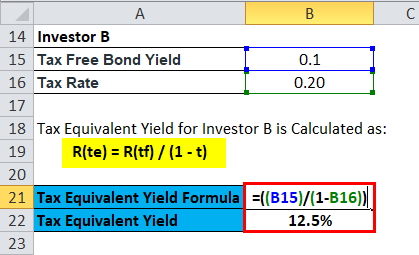

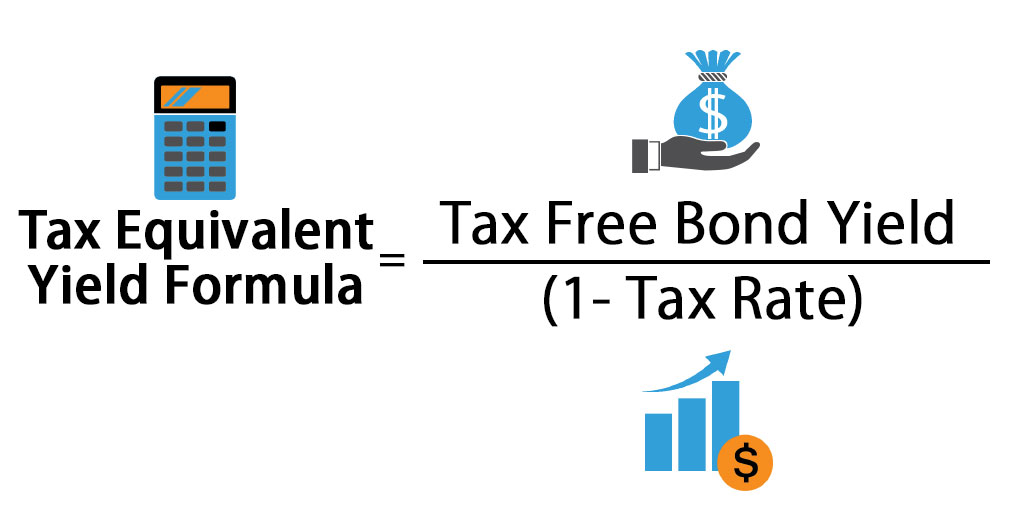

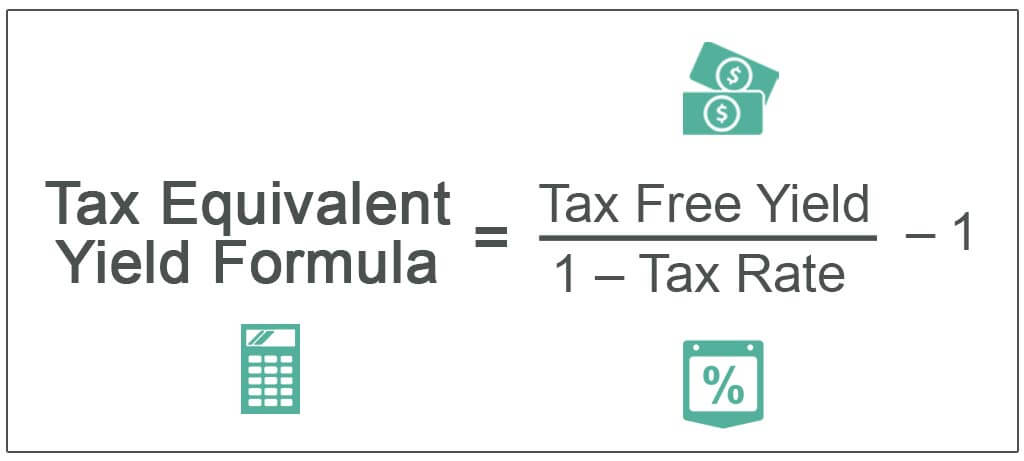

Calculated by taking the yield on the tax-exempt bond and dividing by one minus your marginal tax rate. After solving the equation the original price or value would be 7473. The yield of the bond at point x remember yields are often annualized this yield must be adjusted for periods per year.

The market price of. For example Treasury bonds yields tie to the Feds Fund rate an interest rate risk premium and an inflation risk. Sign doesnt matter But stick with the better convexity formula if you have time to calculate it or come back and visit this page.

Additionally both formulas tell the investor that the tax-exempt bond has a higher tax. Let us take another example where the company with net earnings of 60000 during the year 20XX has decided to retain 48000 in the business while paying out the remaining to the shareholders in the form of dividends. A 6 year bond was originally issued one year ago with a.

The YTM formula needs 5 inputs. So the price would decrease by only 4064 instead of 4183. A bond yield is the amount of return an investor realizes on a bond.

So the price at a 1 increase in yield as predicted by Modified duration is 86954 and as predicted using modified duration Modified. The yield to maturity makes bonds easier to compare as they examine the period closer to the bonds maturity. Several types of bond yields exist including nominal yield which is the interest paid divided by the face value of.

The face value is equivalent to the principal of the bond. The Taxable-Equivalent Yield TEY represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis at a specified tax rate. Plugging in the calculation formula you calculate the yield as follows.

To see how the number of annual coupon payments received affects the effective yield on your bond let us do another effective yield calculation that assumes you receive monthly coupon payments 12 interest payments each year. The payout of the bond at point x. Tax-equivalent yield TEY.

For instance if the yield curve is upward-sloping the long-term YTM such as the 10-year YTM is higher than the short-term. The current yield on a bond depicts the annual coupon as a percentage of the market price which could be higher or lower than par. Example of Zero Coupon Bond Formula with Rate Changes.

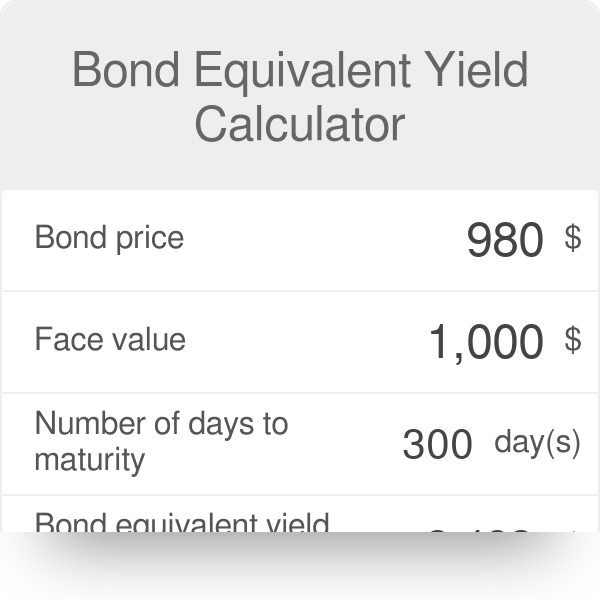

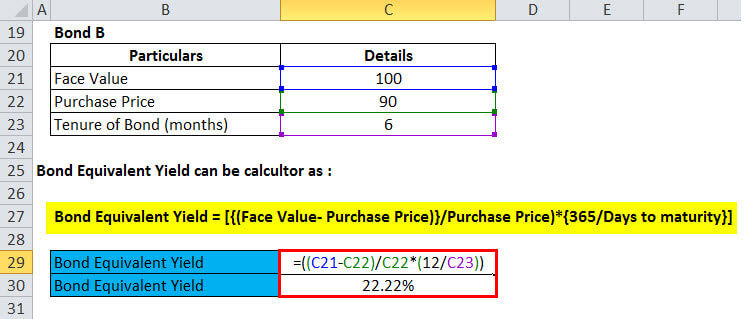

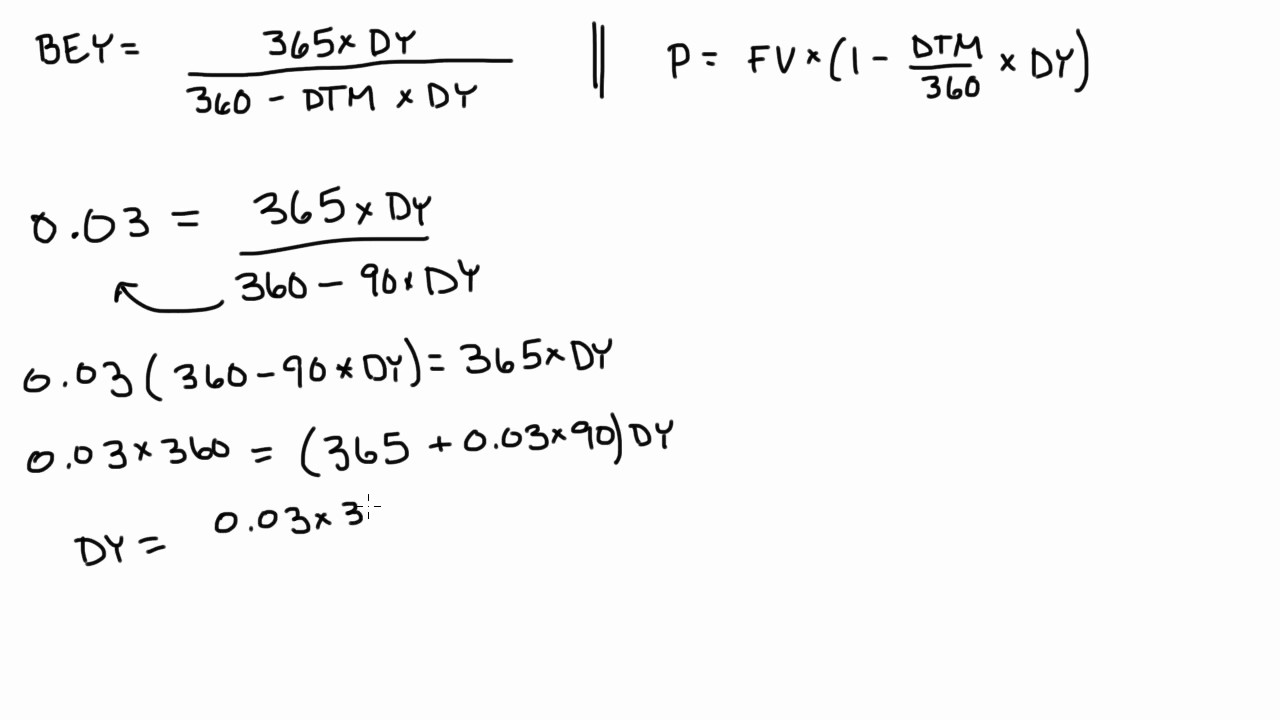

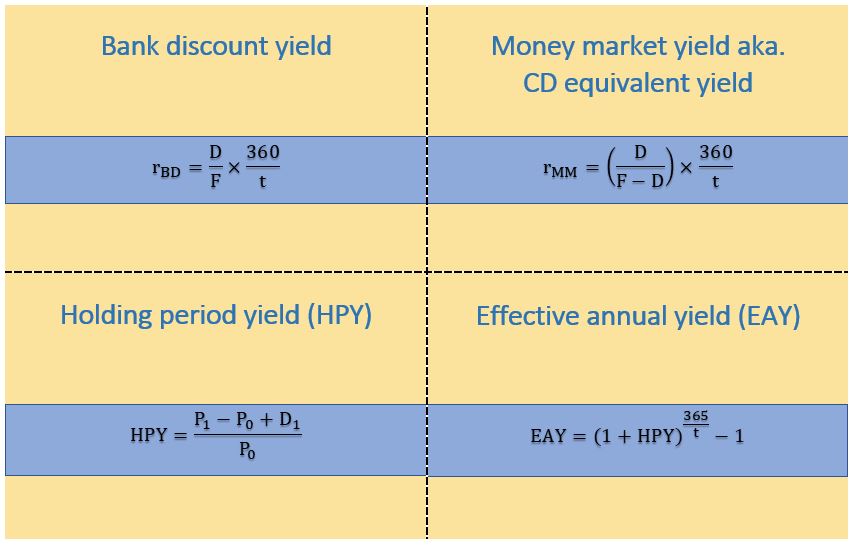

After paying 22 on the income from your taxable bond your tax-equivalent yield is 78 which is below the 8 yield on the tax-exempt bond. The SEC 30-Day Yield is computed under an SEC standardized formula and is based on the maximum offer price per share. The bond equivalent yield BEY allows fixed-income securities whose payments are not annual to be compared with securities with annual yields.

The number of shares the preference shareholder is holdingPreference shareholders are entitled to get fixed dividends on a regular interval. The formula shows the advantage of tax-exempt bonds. For our example face value 1000.

Bond Equivalent Yield - BEY. The total number of bond payouts in the future assuming no missed payment yield. Bond price - Price of the bond.

The rate at which the dividend will be paid out it is. The BEY is a. This has been a guide to Bond Yield Formula.

In order for that bond paying 8 to become equivalent to a new bond paying 9 it must trade at a discounted bond. The PV is calculated by discounting the cash flow using yield to maturity YTM. Bond price when yield decreases by 1 Price.

Percentage point change in yield note that its squared. Helps you compare bonds that are tax-exempt and those that are not. Hence it is clear that if bond price decrease bond yield increase.

Bond Equivalent Yield Calculator Bey

Bond Yield Formula Calculator Example With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Bond Equivalent Yield Formula Calculator Excel Template

Bond Equivalent Yield Example 2 Youtube

Tax Equivalent Yield Formula Calculator Excel Template

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Bond Equivalent Yield Prepnuggets

Money Market Yields For Level 1 Cfa Candidates Soleadea

Tax Equivalent Yield Formula Calculator Excel Template

债券等值收益率公式 逐步计算 举例 万搏体育app网站

Bond Equivalent Yield Prepnuggets

Tax Equivalent Yield Meaning Formula How To Calculate

Bond Equivalent Yield Formula With Calculator

Bond Equivalent Yield Formula Calculator Excel Template

Current Yield Bond Formula And Calculator Excel Template

Bond Equivalent Yield Bey Definition